| | | ☐ | | Preliminary Proxy Statement | ☐ | | ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e) 14a‑6(e)(2)) | ☒ | | ☒ | | Definitive Proxy Statement | ☐ | | ☐ | | Definitive Additional Materials | ☐ | | ☐ | | Soliciting Material under§240.14a-12 §240.14a‑12 |

Trinseo S.A. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | | | Payment of Filing Fee (Check the appropriate box): | | | | | ☒ | | ☒ | | No fee required. | ☐ | | ☐ | | Fee computed on table below per Exchange Act Rules14a-6(i) 14a‑6(i)(1)and 0-11.0‑11. | | | | | | (1) | | Title of each class of securities to which transaction applies: | | | | | | (2) | | Aggregate number of securities to which transaction applies: | | | | | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): | | | | | | (4) | | Proposed maximum aggregate value of transaction: | | | | | | (5) | | Total fee paid: | | | | ☐ | | ☐ | | Fee paid previously with preliminary materials. | ☐ | | ☐ | | Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | | | | | | (1) | | Amount Previously Paid: | | | | | | (2) | | Form, Schedule or Registration Statement No.: | | | | | | (3) | | Filing Party: | | | | | | (4) | | Date Filed: | | | | | | |

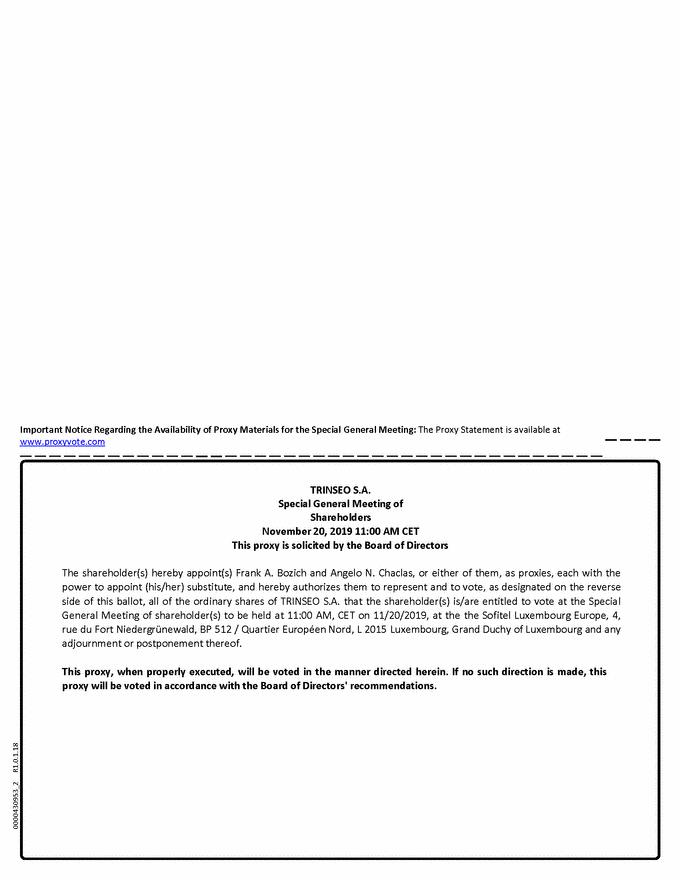

Trinseo S.A. ExtraordinarySpecial General Meeting of Shareholders

Luxembourg, Grand Duchy of Luxembourg November 28, 201720, 2019 Meeting begins at 5:20 p.m. CEST11:00 a.m. CET; Doors Open at 5:00 p.m. CEST10:45 a.m. CET Sofitel Luxembourg Europe 4, rue du Fort Niedergrünewald BP 512 / Quartier Européen Nord L-2015L‑2015 Luxembourg

Grand Duchy of Luxembourg Registered office of Trinseo S.A.: 46A avenue John F. Kennedy26‑28, rue Edward Steichen

L-1855L‑2540 Luxembourg

Grand Duchy of Luxembourg Principal executive offices of Trinseo S.A. 1000 Chesterbrook Boulevard, Suite 300 Berwyn, Pennsylvania 19312 USA (610) 240-3200+1 610‑240‑3200

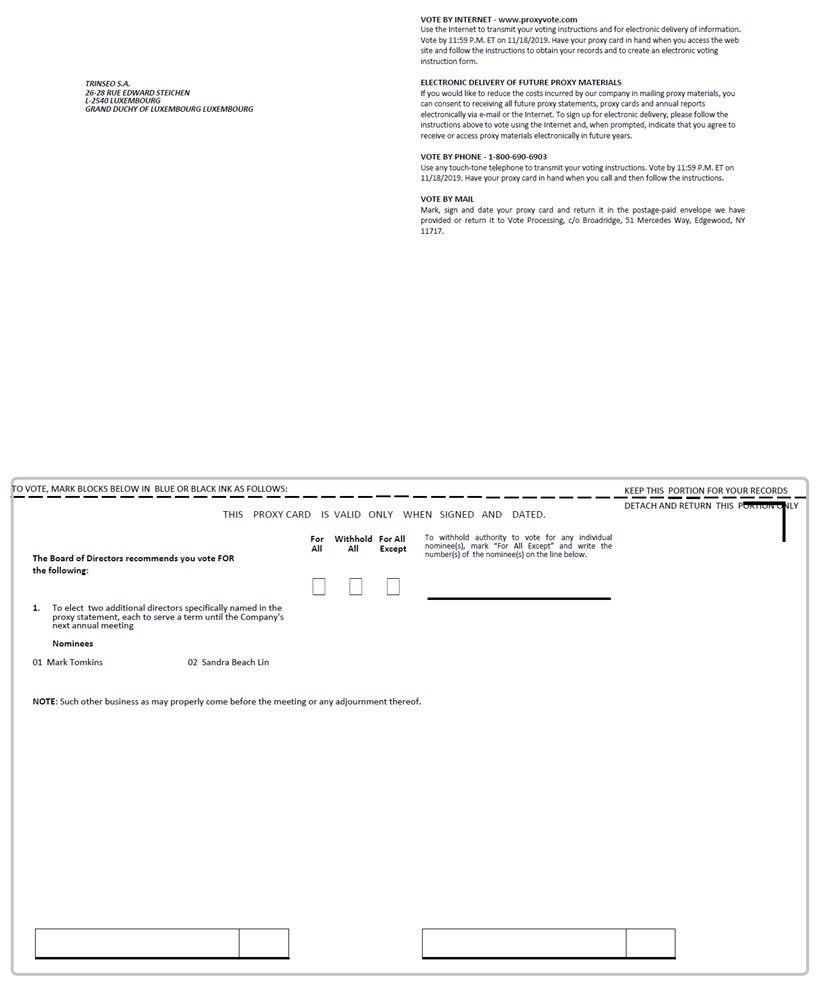

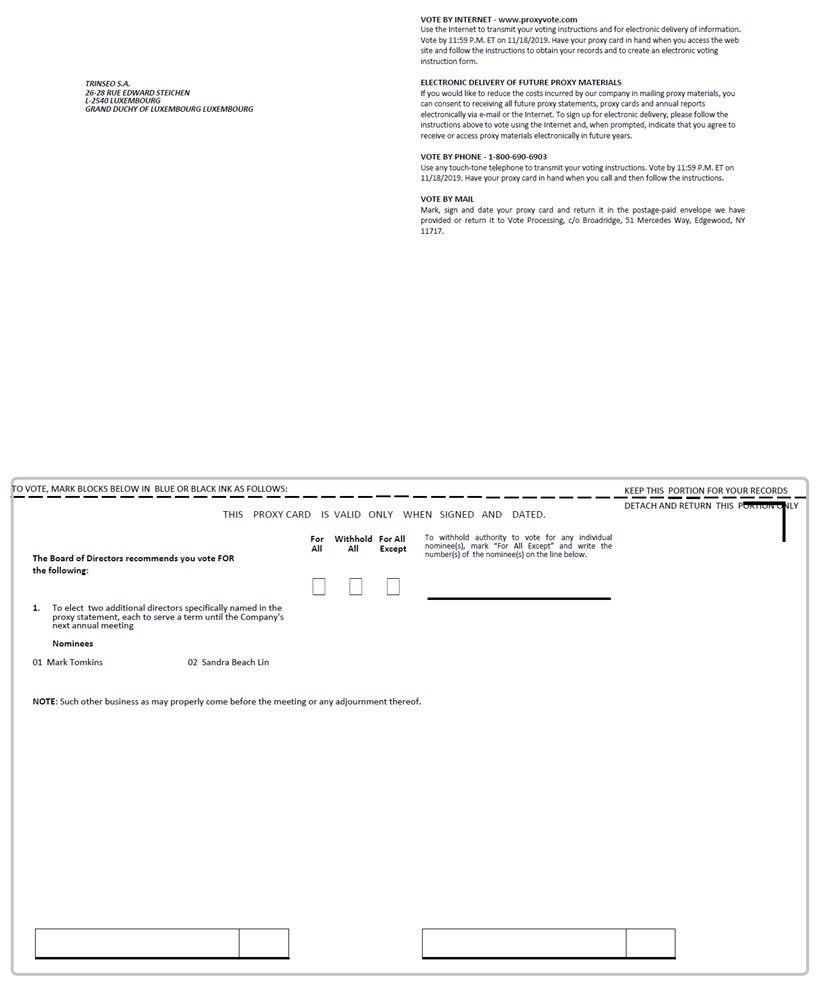

NOTICE OF EXTRAORDINARYSPECIAL GENERAL MEETING OF SHAREHOLDERS To the Shareholders of Trinseo S.A.: Notice is hereby given that an Extraordinarya Special General Meeting of Shareholders of Trinseo S.A. (“we,” “Trinseo” or the “Company”) will be held at the Sofitel Luxembourg Europe, 4, rue du Fort Niedergrünewald, BP 512 / Quartier Européen Nord,L-2015 L‑2015 Luxembourg, Grand Duchy of Luxembourg on Tuesday,Wednesday, November 28, 2017,20, 2019, at 5:20 p.m.11:00 a.m., local time, for the purposes described below and in further detail in the proxy statement accompanying this notice: First, for the purpose of approving an ordinary resolution:resolutions in order: 1.To elect two additional directors specifically named in the proxy statement, each to serve a term until the Company’s next annual meeting. 1. | To elect one Class III director, Mr. Henri Steinmetz, to serve for a term until the 2020 annual general meeting of shareholders. |

Second, for the purpose of approving or authorizing any other business properly brought before the ExtraordinarySpecial General Meeting of Shareholders. It is expected that thisthe Notice of ExtraordinarySpecial General Meeting and this proxy statement will first be available to shareholders on or about October 20, 2017.21, 2019. Shareholders of record at the close of business on October 17, 201718, 2019 are entitled to notice of, and entitled to vote at, the ExtraordinarySpecial General Meeting and any adjournments or postponements thereof. To attend the ExtraordinarySpecial General Meeting, you must demonstrate that you were a Trinseo shareholder as of the close of business on October 17, 2017,18, 2019, or hold a valid proxy for the ExtraordinarySpecial General Meeting from such a shareholder. | | | By Order of the Board of Directors | |

| | /s/ Angelo N. Chaclas | | Angelo N. Chaclas | | Senior Vice President, Chief Legal Officer, Chief | | Compliance Officer and Corporate Secretary | | October 20, 201718, 2019 |

Important Notice Regarding the Availability of Proxy Materials for the Special General Meeting to be held on November 20, 2019: our proxy statement is attached. Financial and other information concerning Trinseo are contained in our Annual Report to shareholders for the fiscal year ended December 31, 2018. The proxy statement and our fiscal 2018 Annual Report to shareholders are available on the Investor Relations section of our website at www.investor.trinseo.com. Additionally, you may access our proxy materials at www.proxyvote.com, a site that does not have “cookies” that identify visitors to the site.

Table of Contents

PROXY STATEMENT

Proxy Statement

Our Board of Directors (the “Board”) of Trinseo S.A. solicits your proxy for the Extraordinary General Meeting of Shareholders (the “Extraordinary Meeting”) to be held on November 28, 2017, and at any adjournments or postponements of the Extraordinary Meeting, for the purposes set forth in the Notice of the Extraordinary General Meeting of Shareholders included in this proxy statement. As

Proxy Statement the terms “we,” “us,” “our” “Company” or “Trinseo” refer to Trinseo S.A. Proxy materials, including this Proxy Statement are being first provided to shareholders on or about October 20, 2017. Our registered address is 46A avenue John F. Kennedy,L-1855 Luxembourg, Grand Duchy of Luxembourg. | | | Our Board of Directors (the “Board”) of Trinseo S.A. solicits your proxy for the Special General Meeting of Shareholders (the “Meeting”) to be held on November 20, 2019, and at any adjournments or postponements of the Meeting, for the purposes set forth in the Notices of the Special General Meeting of Shareholders included in this proxy statement. As used in this Proxy Statement, the terms | | “we,” “us,” “our” “Company” or “Trinseo” refer to Trinseo S.A. Proxy materials, including this Proxy Statement that is being first provided to shareholders on or before October 21, 2019. Our registered address is 26‑28, rue Edward Steichen, L‑2540 Luxembourg, Grand Duchy of Luxembourg. |

2  2019ProxyStatement 2019ProxyStatement Table of Contents QUESTIONS AND ANSWERS ABOUT THE SPECIALGENERAL MEETING AND THE PROXY MATERIALS Questions and Answers about the ExtraordinarySpecial General Meeting and the Proxy Materials Where is the Extraordinary Meeting being held?

We will hold the Extraordinary Meeting at 5:20 p.m., local time on Tuesday, November 28, 2017 at the Sofitel Luxembourg Europe hotel located at 4, rue du Fort Niedergrünewald, BP 512 / Quartier Européen Nord,L-2015 Luxembourg, Grand Duchy of Luxembourg. When you arrive in the lobby, check in at the front desk and ask to be directed to the Trinseo Extraordinary Meeting. We reserve the right to request that you to present a photo ID and verify your status as a shareholder. We will not permit cameras or other recording devices at the Extraordinary Meeting. All cell phones must be turned off once the Extraordinary Meeting is convened.

What will shareholders vote on at the Extraordinary Meeting?

Shareholders will be asked to vote:

Special Meeting at 11:00 a.m., local time, on Wednesday, November 20, 2019 at the Sofitel Luxembourg Europe hotel located at 4, rue du Fort Niedergrünewald, BP 512 / Quartier Européen Nord, L‑2015 Luxembourg, Grand Duchy of Luxembourg. When you arrive in the lobby, check in at the front desk and ask to be directed to the Trinseo Special Meeting. We reserve the right to request that you present a photo ID and verify your status as a shareholder. We will not permit cameras or other recording devices at the Special Meeting. All cell phones must be turned off once the Special Meeting is convened. October 11, 2019 we commenced mailing of a Notice of Internet Availability of Proxy Materials to our shareholders of record and beneficial owners. The Notice explains how to access the proxy materials on the Internet and how to vote your proxy for the Special Meeting. If you received the Notice by mail and would like to receive a printed copy of our proxy materials, please follow the instructions for requesting printed materials included in the Notice. 1. | | To elect one Class III director, Mr. Henri Steinmetz,two directors specifically named in the proxy statement, each to serve for a term until the 2020Company’s next annual general meetingmeeting; . To approve, Changes to the Company’s compensation program for non-executive directors. | Where is the Special General Meeting being held? We will hold the Special General Meeting at 11:00 a.m., local time, on Wednesday, November 20, 2019 at the Sofitel Luxembourg Europe hotel located at 4, rue du Fort Niedergrünewald, BP 512 / Quartier Européen Nord, L‑2015 Luxembourg, Grand Duchy of shareholders;Luxembourg. When you arrive in the lobby, check in at the front desk and |

ask to be directed to the Trinseo Special General Meeting. We reserve the right to request that you present a photo ID and verify your status as a shareholder. We will not permit cameras or other recording devices at the Special General Meeting. All cell phones must be turned off once the Special General Meeting is convened. 2. | | What will shareholders vote on at the Special General Meeting? Shareholders will be asked to vote: 1. To elect two directors specifically named in the proxy statement, each to serve a term until the Company’s next annual meeting; and 2. Any other business properly brought before the Extraordinary Meeting of Shareholders.Special General Meeting. | | | |

We do not expect any other matters to be presented at the meeting. If other matters are properly presented for voting, the persons named as proxies will vote in accordance with their best judgment on those matters.

Who is entitled to vote at the Extraordinary Meeting?

Shareholders of record as of the close of business on October 17, 2017 are entitled to vote at the Extraordinary Meeting. On that date, there were 43,703,314 of our ordinary shares outstanding. Each ordinary share is entitled to one vote.

What is a shareholder2019 Proxy Statement  3 3

Table of record?Contents If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered the shareholder of record for those shares. As the shareholder of record, you have the right to vote your shares.

If your shares are held in a stock brokerage account or by a bank, or other holder of record, you are considered the beneficial owner of shares held in street name. Your broker, bank, or other holder of record is the shareholder of record for those shares. As the beneficial owner, you have the right to direct your broker, bank, or other holder of record on how to vote your shares.

What constitutes a quorum for consideration of proposals at the Extraordinary Meeting?

Under our Articles of Association, the holders of a majority of the ordinary shares outstanding and entitled to vote at the Extraordinary Meeting shall constitute a quorum for the transaction of business at the Extraordinary Meeting. Ordinary shares represented in person or by proxy will be counted for purposes of determining whether a quorum is present. Abstentions and brokernon-votes (if any) will be treated as present at the Extraordinary Meeting and will be counted for quorum purposes.

How many votes are required at the Extraordinary Meeting to elect the director nominee?

The proposal to elect the director nominee requires the affirmative vote of a majority of the ordinary shares represented in person or by proxy at the Extraordinary Meeting and entitled to vote.

| | | | | | | 2017 Proxy Statement | | |  | | | 1 |

QUESTIONS AND ANSWERS ABOUT THE EXTRAORDINARYSPECIAL GENERAL MEETING AND THE PROXY MATERIALS Who is entitled to vote at the Special General Meeting? Shareholders of record as of the close of business on October 18, 2019 are entitled to vote at the Special General Meeting. On that date, there were 39,280,112 of our ordinary shares outstanding. Each ordinary share is entitled to one vote. What is a shareholder of record? If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered the shareholder of record for those shares. As the shareholder of record, you have the right to vote your shares. If your shares are held in a stock brokerage account or by a bank, or other holder of record, you are considered the beneficial owner of shares held in street name. Your broker, bank, or other holder of record is the shareholder of record for those shares. As the beneficial owner, you have the right to direct your broker, bank, or other holder of record on how to vote your shares. What constitutes a quorum for consideration of proposals at the Special General Meeting? Under our Articles of Association, the holders of a majority of the ordinary shares outstanding and entitled to vote at the Special General Meeting shall constitute a quorum for the transaction of business at the Special General Meeting. Ordinary shares represented in person or by proxy will be counted for purposes of determining whether a quorum is present. Abstentions and broker non-votes (if any) will be treated as present at the Special General Meeting and will be counted for quorum purposes and will vote in accordance with their best judgment on those matters. | | How many votes are required to elect directors and to adopt the other proposals at the Special General Meeting? The election of directors and each of the other proposals related to the ordinary resolutions to be voted on require the affirmative vote of a majority of the ordinary shares represented in person or by proxy at the Special General Meeting and entitled to vote. For advisory votes, the Board takes the voting results under advisement. How do I vote? If you are a shareholder of record, you may vote in person at the meeting. If you do not wish to vote in person or if you will not be attending the Special General Meeting, you may vote by telephone, or over the Internet, by following the instructions provided in the voting instructions. You may also complete, sign, and date your proxy card and return it in the prepaid envelope that was included with the proxy materials that you received. If you are a beneficial owner of shares and you wish to vote in person at the Special General Meeting, you must obtain a proxy for the Special General Meeting from your broker, bank, or other shareholder of record and present it to the inspector of election with your ballot. If you do not wish to vote in person or will not be attending the Special General Meeting, you may vote by following the instructions provided in the voting instructions you received from the shareholder of record of your shares. You should have received a proxy card and voting instructions from the shareholder of record of your shares. If you are a shareholder of record, you will receive one proxy card for the Special General Meeting. If you are a shareholder of record, you may vote in person at the meeting. If you do not wish to vote in person or if you will not be attending the meeting, you may vote by telephone, or over the Internet, by following the instructions provided on your proxy card. You may also complete, sign, and date your proxy card and return it in the prepaid envelope that was included with the printed materials.

If you are a beneficial owner of shares and you wish to vote in person at the Extraordinary Meeting, you must obtain a proxy from your broker, bank, or other shareholder of record and present it to the inspector of election with your ballot. If you do not wish to vote in person or will not be attending the Extraordinary Meeting, you may vote by following the proxy voting instructions provided with the proxy materials you received from the shareholder of record of your shares. If you received a printed copy of the proxy materials, you should have received a proxy card and voting instructions from the shareholder of record of your shares.

If you submit a signed proxy card for the Extraordinary Meeting but do not fill out the voting instructions, the persons named as proxy holders will vote the shares represented by your proxy “FOR” authorizing the Company, with approval of the Board, to elect one Class III director, Mr. Henri Steinmetz, to serve for a term until the 2020 annual general meeting of shareholders.

If there are not sufficient votes to approve the Proposal at the Extraordinary Meeting, in accordance with the Company’s Articles of Association, the chairman may adjourn the Extraordinary Meeting to permit the further solicitation of proxies. Additionally, under Luxembourg law, the Board may adjourn the Extraordinary Meeting for up to four weeks. The persons named as proxies will vote those proxies for such adjournment, unless marked to be voted against the Proposal, to permit the further solicitation of proxies. Abstentions and brokernon-votes, if any, will not have any effect on the result of the vote for adjournment. If any nominee should become unavailable, your shares will be voted for another nominee selected by the Board or for only the remaining nominees.

Brokers are not permitted to vote your shares on the Proposal. If your shares are held in the name of a broker or nominee and you do not instruct the broker or nominee how to vote or if you abstain or withhold authority to vote, your shares will not be counted as having been voted, but will be counted as in attendance at the meeting for purposes of a quorum.

If you do not vote your shares, you will not have a say on the important proposal to be voted upon at the Extraordinary Meeting.

What happens if I abstain from voting or my broker withholds my vote?

For the proposal to be considered at the meeting, abstentions are treated as shares that are represented and entitled to vote, so abstaining has the same effect as a negative vote. Shares held by brokers that do not have discretionary authority to vote on the proposal and that have not received voting instructions from their customers are not counted as being represented or entitled to vote on the proposal, which has the effect of reducing the number of affirmative votes needed to approve the proposal.

Should I submit a proxy even if I plan to attend the Extraordinary Meeting in person?

To ensure that your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the Extraordinary Meeting in person. If you attend the Extraordinary Meeting in person and are a shareholder of record, you may also submit your vote in person, and any previous votes that you submitted will be superseded by the vote that you cast at the Extraordinary Meeting. Internet and phone voting will becut-off at 11:59 p.m., Eastern Time, on November 27, 2017.

Who will bear the cost of soliciting votes for the Extraordinary Meeting?

We will bear the expense of the solicitation of proxies for the Extraordinary Meeting. Solicitation of proxies may be made by mail, in person or telephone by officers, directors and other employees of the Company and by employees of Broadridge Financial Solutions, Inc. (“Broadridge”). We will reimburse Broadridge and the Company’s banks, brokers, and other custodians, nominees and fiduciaries for their reasonable costs in the preparation and mailing of proxy materials to shareholders.

A shareholder may also choose to vote electronically by accessing the Internet site stated on their proxy card or proxy voting instructions or by using the toll-free telephone number provided in in its proxy card or proxy voting instructions. Shareholders that vote through the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, which will be borne by the shareholder.

Can I revoke my proxy?

Your proxy may be revoked by giving notice of revocation to Trinseo in writing, by accessing the Internet site, by using the

| | | | | | | 2 | | |  | | | 2017 Proxy Statement |

4  2019ProxyStatement 2019ProxyStatement Table of Contents QUESTIONS AND ANSWERS ABOUT THE EXTRAORDINARYSPECIALGENERAL MEETING AND THE PROXY MATERIALS toll-free telephone number, or in person at the Extraordinary Meeting. A shareholder may also change his or her vote by executing and returning to the Company a later-dated proxy, by submitting a later-dated electronic vote through the Internet site, by using the toll-free telephone number or in person at the applicable Extraordinary Meeting.

The Internet and telephone procedures for voting and for revoking or changing a vote are designed to authenticate shareholders’ identities, to allow shareholders to give their voting instructions and to confirm that shareholders’ instructions have been properly recorded.

If you are a shareholder of record and submit a signed proxy card for the Special General Meeting but do not fill out the voting instructions, the persons named as proxy holders will vote the shares represented by your proxy “FOR” the authorization of the Company, with approval of the Board, to elect two directors specifically named in the proxy statement, each to serve a term until the Company’s next annual meeting. If there are not sufficient votes to approve one or more of the proposals at the Special General Meeting, in accordance with the Company’s Articles of Association, the chairman may adjourn the Special General Meeting to permit the further solicitation of proxies. Additionally, under Luxembourg law, the Board may adjourn the Special General Meeting for up to four weeks. The persons named as proxies will vote those proxies for such adjournment, unless marked to be voted against the proposal, to permit the further solicitation of proxies. Abstentions and broker non-votes, if any, will not have any effect on the result of the vote for adjournment. If any nominee should become unavailable, your shares will be voted for another nominee selected by the Board or for only the remaining nominees. | | Brokers are not permitted to vote your shares on any matter. If your shares are held in the name of a broker or nominee and you do not instruct the broker or nominee how to vote with respect to the election of directors or if you abstain or withhold authority to vote on any matter, your shares will not be counted as having been voted on those matters, but will be counted as in attendance at the meeting for purposes of a quorum. If you do not vote your shares, you will not have a say on the important issues to be voted upon at the Special General Meeting. What happens if I abstain from voting on a matter or my broker withholds my vote? For each matter to be considered at the Special General Meeting, abstentions are treated as shares that are represented and entitled to vote, so abstaining has the same effect as a negative vote. Shares held by brokers that do not have discretionary authority to vote on a particular proposal and that have not received voting instructions from their customers are not counted as being represented or entitled to vote on the proposal, which has the effect of reducing the number of affirmative votes needed to approve the proposal. |

2019 Proxy Statement  5 5 Table of Contents QUESTIONS AND ANSWERS ABOUT THE SPECIAL GENERAL MEETING AND THE PROXY MATERIALS Should I submit a proxy even if I plan to attend the Special General Meeting in person? To ensure that your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the Special General Meeting in person. If you attend the Special General Meeting in person and are a shareholder of record, you may also submit your vote in person, and any previous votes that you submitted will be superseded by the vote that you cast at the Special General Meeting. Internet and phone voting will be cut-off at 11:59 p.m., Eastern Time, on November 18, 2019. Can I revoke my proxy? Your proxy may be revoked by giving notice of revocation to Trinseo in writing, by accessing the Internet site, by using the toll-free telephone number, or in person at the Special General Meeting. A shareholder may also change his or her vote by executing and returning to the Company a later-dated proxy, by submitting a later-dated electronic vote through the Internet site, by using the toll-free telephone number or in person at the Special General Meeting. The Internet and telephone procedures for voting and for revoking or changing a vote are designed to authenticate shareholders’ identities, to allow shareholders to give their voting instructions and to confirm that shareholders’ instructions have been properly recorded. | | | | | | Who will bear the cost of soliciting votes for the Special General Meeting? We will bear the expense of the solicitation of proxies for the Special General Meeting. Solicitation of proxies may be made by mail, in person or telephone by officers, directors and other employees of the Company and by employees of Broadridge Financial Solutions, Inc. (“Broadridge”). We agreed to pay Broadridge a fee of approximately $43,000 for their assistance with the solicitation of proxies. Additionally, we will reimburse Broadridge and the Company’s banks, brokers, and other custodians, nominees and fiduciaries for their reasonable costs in the preparation and mailing of proxy materials to shareholders. A shareholder may also choose to vote electronically by accessing the Internet site stated in the voting instructions or by using the toll-free telephone number stated in the voting instructions. Shareholders that vote through the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, which will be borne by the shareholder. | 2017 Proxy Statement | | |  | | | 3 |

PROPOSAL 1—ELECTION OF CLASS III DIRECTOR

6  2019ProxyStatement 2019ProxyStatement Proposal 1—1–Election of Class III DirectorDirectors Trinseo has a classified board of directors currently consisting of three directors with terms expiring in 2018 (Class I), three directors with terms expiring in 2019 (Class II), and two directors with terms expiring in 2020 (Class III). At each annual general meeting of shareholders, directors in one class are elected for a full term of three years to succeed those directors whose terms are expiring.

The Class III director nominee, Mr. Henri Steinmetz, will stand for election to serve for a term expiring at the 2020 annual general meeting. The persons named in the enclosed proxy will vote to elect Mr. Steinmetz unless the proxy is marked otherwise. Mr. Steinmetz has indicated his willingness to serve, if elected. However, if Mr. Steinmetz should be unable to serve, the ordinary shares represented by proxies may be voted for a substitute nominee designated by the Board. Management has no reason to believe that Mr. Steinmetz will not serve his term as a director.

We seek nominees with established strong professional reputations, sophistication, business acumen and experience in the global materials, chemical and related manufacturing industries. We also seek nominees with experience in

substantive areas that are important to our business such as chemical industry expertise, international operations; accounting, finance and capital structure; strategic planning and leadership of complex organizations; human resources and development practices; and innovation. In addition, we believe that our nominees should possess the professional and personal qualifications necessary for board service, and we have highlighted particularly noteworthy attributes in each of the biographies of our directors and our nominee below.

Mr. Steinmetz is a new director nominee nominated by the Board to fill the seat vacated by Jeannot Krecké and is standing for election at this Extraordinary General Meeting. If elected, he will hold office until our 2020 annual general meeting of shareholders and until his successor is duly elected and qualified. Mr. Steinmetz offers our Board decades of experience in the chemical industry as well as a global perspective and significant chief executive officer experience. Mr. Steinmetz will not be able to serve as a director unless his appointment is approved by a majority of the votes cast by our shareholders.

| | | Trinseo has a Board consisting of three directors with terms expiring in 2020 (Class III), three directors with terms expiring in 2021 (Class I) and four directors with terms expiring annually. Last year our shareholders approved an amendment to our Articles of Association to declassify our Board. With this amendment, as the term of each of the director classes expires, each class of directors will only be elected for an annual term. Therefore, each of the two director nominees will stand for election at the Company’s next annual general meeting. The persons named in the enclosed proxy will vote to elect Mr. Mark Tomkins and Ms. Sandra Beach Lin as directors unless the Proxy is marked otherwise. Each of the nominees has indicated his or her willingness to serve, if elected. However, if a nominee should be unable to serve, the ordinary shares represented by proxies may be voted for a substitute nominee designated by the Board. Management has no reason to believe that any of the above-mentioned persons will not serve his or her term as a director. We seek nominees with established strong professional reputations, sophistication, business acumen and experience in the global materials, chemical and related manufacturing industries. | | We also seek nominees with experience in substantive areas that are important to our business such as chemical industry expertise, international operations; accounting, finance and capital structure; strategic planning and operational leadership of complex organizations; human resources and development practices; and innovation. In addition, we believe that our nominees should possess the professional and personal qualifications necessary for board service, and we have highlighted particularly noteworthy attributes in each of the biographies of our directors and our nominees below. 2019 Director Nominees The individuals listed below have been nominated by the Board upon the recommendation of the nominating and corporate governance committee and are standing for election at this Special General Meeting. If elected, they will hold office until our 2020 annual general meeting of shareholders and until their successors are duly elected and qualified. If Mr. Mark Tomkins and Ms. Sandra Beach Lin nominations are not approved, they will not serve as members of the Company’s Board. |

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR”

THE ELECTION OF HENRI STEINMETZ AS A CLASS III DIRECTOR.

. | YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES AS DIRECTOR. |

| | | | | | | 4 | | |  | | | 2017 Proxy Statement |

2019 Proxy Statement  7 7 2019 Director Nominee with Term Expiring in 2020 (Class III Director) Mr. Mark Tomkins | | | | |  | | Age: 64 HENRI STEINMETZ

Age:61

| | |

Professional Experience: Since 2016From 2005 to 2006, Mr. Steinmetz has served as Chief Executive Officer of the Ceramtec Group, a global supplier of advanced ceramics. From 2009 to 2016, Mr. SteinmetzTomkins was Executive Director and Chief Executive Officer of Ruetgers N.V., Europe’s leading manufacturer of chemical raw materials made from coal tar. Prior to joining Ruetgers N.V., Mr. Steinmetz was President of Sulzer Metco, a worldwide technology leader in coating materials, from 2004 to 2008, and an Executive Vice President at Great Lakes Chemical Corporation from 2000 to 2004.

Education:

Mr. Steinmetz graduated with a M.S. in metallurgy from the Technical University Clausthal, Germany and has an MBA from INSEAD Fontainebleau, France.

Other Public Company Directorships:

None

Director Qualifications:

Mr. Steinmetz has significant global chief executive officer experience and decades of chemical industry experience, which make him well-positioned to provide significant contributions to our Board.

| | | | | | | 2017 Proxy Statement | | |  | | | 5 |

PROPOSAL 1—ELECTION OF CLASS III DIRECTOR

Directors with Terms Expiring in 2018 (Class I Directors)

| | | | |  | | JOSEPH ALVARADO

Age:65

Director Since:March 2017

Committee Membership:

• Audit

• Environmental, Health, Safety & Public Policy

| | |

Professional Experience:

Mr. Alvarado is Chairman and Chief Executive Officer of Commercial Metals Company (NYSE: CMC), a global manufacturer, recycler and marketer of steel and other metals. He joined CMC in April 2010 as ExecutiveSenior Vice President and Chief OperatingFinancial Officer was named Presidentof Innovene, at the time, a leading petrochemical and Chief Operating Officer in April 2011, and became President and Chief Executive Officer in September 2011. In January 2017, he passed his President title to his Chief Operating Officer. He has been Chairman of CMC’s board of directors since January 2013.polymers company. Prior to joining CMC, heInnovene, Mr. Tomkins was Senior Vice President, Chief Financial Officer and Chief Operating OfficerTreasurer of Lone Star Technologies, Inc.Vulcan Minerals, a mineral exploration company, from 20042001 to 2007. In June 2007, following the acquisition of Lone Star Technologies, Inc. by United States Steel Corporation, Mr. Alvarado was named President of U.S. Steel Tubular Products, Inc.2005. He joined Great Lakes Chemical Corp., a division of United States Steel Corporation, a position he held until March 2009. Mr. Alvarado began his career at Inland Steel Company in 1976chemical research, production, sales and spent 21 years with thedistribution company in roles of increasing responsibility. He then served in executive roles with Birmingham Steel Corporation and Ispat North America Inc. until joining Lone Star Technologies.

Education:

Mr. Alvarado has an MBA from Cornell University and a B.A. degree in Economics from University of Notre Dame.

Other Public Company Directorships:

Commercial Metals Company (NYSE: CMC) since 2011

Spectra Energy Corp (NYSE: SE) from 2011 until February 2017

Director Qualifications:

Mr. Alvarado brings years of experience in a cyclical commodities-driven industry and significant perspective on global operations and strategic planning.

| | | | | | | 6 | | |  | | | 2017 Proxy Statement |

PROPOSAL 1—ELECTION OF CLASS III DIRECTOR

| | | | |  | | JEFFREY J. COTE

Age:50

Director Since:May 2014

Committee Membership:

• Audit

• Compensation

| | |

Professional Experience:

Mr. Cote has served as Chief Operating Officer of Sensata Technologies Holding N.V. (NYSE: ST) since July 2012 and as Executive Vice President of its Global Sensing Solutions business since November 2015. He joined Sensata as Senior Vice President and Chief Financial Officer in January 2007, and was appointed Executive Vice President in July 2007. From March 2005from 1998 to December 2006, Mr. Cote was Chief Operating Officer of the law firm Ropes & Gray. From January 2000 to March 2005, Mr. Cote was Chief Operating, Financial and Administrative Officer of Digitas. Previously he worked for Ernst & Young LLP from 1989 until 1997. Mr. Cote is a certified public accountant.2001.

Education: Mr. Cote receivedTomkins graduated with a B.A. degreeBachelor of Science in Business AdministrationFinance and a Master of AccountingQuantitative Management and has an MBA from Florida AtlanticEastern Illinois University. Other Public Company Directorships: NoneCurrent Directorships-

ServiceMaster (NYSE: SERV) since 2015 WR Grace & Co (NYSE: GRA) since 2006 Past Directorships- Klockner Pentaplast since 2016 (Advisory) Elevance Renewable Sciences from 2007 to 2014 CVR Energy (NYSE: CVI) from 2007 to 2012 Director Qualifications:Mr. Tomkins is a certified public accountant. Mr. Tomkins’ financial, accounting and management expertise, along with his experience on other public and private company boards, qualify him to serve on the Company’s Board. Mr. Cote brings significant management, capital markets

8  2019ProxyStatement 2019ProxyStatement 2019 Director Nominee with Term Expiring in 2020 Ms. Sandra Beach Lin Age: 61 Professional Experience: From 2010 to 2011, Ms. Beach Lin was President and accountingChief Executive Officer of Calisolar, Inc., a manufacturer of solar silicon and multicrystalline solar cells. Prior to joining Calisolar, she was Corporate Executive Vice President, then Corporate Executive Vice President, at Celanese Corporation, a global technology and specialty materials company, from 2007 to 2010. Ms. Beach Lin joined Avery Dennison Corporation, a global leader in pressure-sensitive adhesives technology as Group Vice President from 2005 to 2007. Prior to joining Avery Dennison, from 2002 to 2005, she was President, Alcoa Closure Systems International, a division of Alcoa Incorporated, a global aluminum leader. From 1994 to 2001, Ms. Beach Lin held various executive positions at Honeywell International, a Fortune 100 diversified technology and manufacturing leader. Education: Ms. Beach Lin graduated with a Bachelor of Business Administration in General Management from the University of Toledo, Ohio and has an MBA in Marketing and Policy and Control from the University of Michigan, Michigan. Other Public Company Directorships: Current Directorships – American Electric Power (NYSE: AEP) since 2012 Interface Biologics since 2012 Polyone (NYSE: POL) since 2013 Past Directorships- WESCO Internationals from 2002 to 2019 Director Qualifications: Ms. Beach Lin’s extensive senior executive experience, including as a Chief Executive Officer, leading global businesses in multiple industries provides her with valuable skills to ourserve on the Company’s Board. Ms. Lin has a deep understanding of the specialty chemicals industry, a strong operational foundation and wide-ranging international experience. 2019 Proxy Statement  9 9 | | | | |  |

| PIERRE-MARIE DE LEENERFrank A. Bozich

Age: 58 Age:60

Director Since:May 2014 Since June 2019 Committee Membership: • Audit

• Environmental, Health, Safety & Public Policy

| | |

Professional Experience: Mr. De Leener served as interim CEO of Braas Monier Building Group SA from January 2016 to November 2016Bozich became the Company’s President and has been Chairman of its Board of Directors since June 2014. Prior to that, he served as Executive Vice President for PPG Industries, Inc. from July 2010 until December 2012. From June 2008 until August 2011, Mr. De Leener also served as President of PPG Europe S.A. Mr. De Leener previously served as Chief Executive Officer in March 2019. From May 2013 until February 2019, Mr. Bozich had been the President and Chief Executive Officer at the SI Group, Inc., a leading global developer and manufacturer of SigmaKalonphenolic resins and chemicals used in the production of antioxidants, engineering plastics, fuels and lubes, rubber and pharmaceutical ingredients. Prior to joining SI Group Inc., Mr. Bozich held several executive management positions at BASF Corporation, a multi-national chemicals and manufacturing corporation, including President of BASF’s Catalysts Division from 1998 until January 2008. In addition, Mr. De Leener served as a member2010 to 2013, Group Vice President of Precious and Base Metal Service, and Group Vice President of the Total Fina operating committee from 1998 until 2001.Integration Management Office. Prior to BASF, Mr. Bozich was Group Vice President, Enterprise Technologies and Ventures at Engelhard Corporation, which was acquired by BASF in 2006. He has also held leadership positions at Rohm and Haas; Croda Adhesives, Inc.; and Apex Adhesives, which he founded in 1986. Education: Mr. De Leener receivedBozich holds a B.A.bachelor’s degree in Economics and PhilosophyChemistry and a Master of Chemical Engineeringmaster’s degree in Business Administration from Catholicthe University of Louvain, Belgium.Chicago, as well as a master’s degree in Chemistry from the University of Illinois. Other Public Company Directorships: NoneCurrent Directorships-

OGE Energy Corp (NYSE: OGE) since 2016 Director Qualifications: Mr. De Leener brings valuable managementBozich is an accomplished Chief Executive Officer known for his strong personal leadership and track record of driving business growth and corporate transformation. His breadth of experience in leading chemical industry experience to our Board.businesses in diverse and dynamic global markets is well-suited for the Company’s strategic priorities. 10  2019ProxyStatement 2019ProxyStatement | | | | | | | 2017 Proxy Statement | | |  | | | 7 |

PROPOSAL 1—ELECTION OF CLASS III DIRECTOR

Directors with Terms Expiring in 2019 (Class II Directors)

| | | | |  | | PHILIP MARTENS Age: 59 Age:57

Director Since:September 2016 Committee Membership: • Compensation

• Nominating & Corporate Governance

| | |

Professional Experience: From February 2011 to April 2015, Mr. Martens served as President and Chief Executive Officer of Novelis, Inc., a leader in aluminum rolled products and can recycling with worldwide operations. He joined Novelis as President and Chief Operating Officer in April 2009. Prior to his employment with Novelis, Mr. Martens served as Senior Vice President of light vehicle systems for ArvinMeritor Inc., a distributor for engine and transmission parts and President and Chief Executive Officer designate of Arvin Innovation, a leading global provider of dynamic motion and control automotive systems. From 1987 to 2005, Mr. Martens held various product development and engineering roles at Ford Motor Company, including his most recent role as a group vice presidentGroup Vice President of product creation from 2003 to 2005. Education: Mr. Martens has an MBA from University of Michigan and received his B.S. degree in mechanical engineering from Virginia Polytechnic Institute. Other Public Company Directorships: Graphic Current Directorships-

Packaging Holding Company (NYSE: GPK) – since 2013 Past Directorships- Plexus Corporation (NASDAQ: PLXS) – from 2010 until Februaryto 2017 Director Qualifications: Mr. Martens brings to the board of directorsCompany’s Board significant leadership and management experience in global manufacturing operations, along with innovation expertise. 2019 Proxy Statement  11 11 | | | | | | | 8 | | |  | | | 2017 Proxy Statement |

PROPOSAL 1—ELECTION OF CLASS III DIRECTOR

| | | | |  | | CHRISTOPHER D. PAPPAS Age: 63 Age:62

Director Since:October 2010 Committee Membership: • Environmental, Health, Safety & Public Policy

| | |

Professional Experience: Mr. Pappas joined Trinseo aswas the Company’s President and Chief Executive Officer in June 2010 and served as interim chief financial officerChief Financial Officer from November 2015 until June 2016. Mr. Pappas transitioned to the role of Special Adviser to Trinseo’s new President and Chief Executive Officer, Mr. Frank A. Bozich, effective March 2019 and through May 2019. Prior to joining Trinseo, Mr. Pappas held a number of executive positions at NOVA Chemicals of increasing responsibility from July 2000 to November 2009, most recently as President and Chief Executive Officer from May 2009 to November 2009, President & Chief Operations Officer from October 2006 to April 2009 and Vice President and President of Styrenics from July 2000 to September 2006. Before joining NOVA Chemicals, Mr. Pappas was Commercial Vice President of DuPont Dow Elastomers where he joined as Vice President of ethylene elastomers in 1995. Mr. Pappas began his chemicals career in 1978 with The Dow Chemical Company (“Dow”) where he held various sales and managerial positions until 1995. Education: Mr. Pappas holds a B.S. degree in Civil Engineering from the Georgia Institute of Technology and an MBA from the Wharton School of Business at The University of Pennsylvania. Other Public Company Directorships: Current Directorships- FirstEnergy Corp. (NYSE: FE) since 2011 Univar, Inc. (NYSE: UNVR) since 2015 Director Qualifications: Mr. Pappas is highly qualified to serve on ourthe Company’s Board due to his public company board experience and his more than 3040 years of managementbusiness experience with major companies in the chemical industry, and by his previous leadership of the Company since its formation. In these roles he has also acquired and demonstrated substantial financial expertise which is valuable to the Company’s Board. 12  2019ProxyStatement 2019ProxyStatement | | | | | | | 2017 Proxy Statement | | |  | | | 9 |

PROPOSAL 1—ELECTION OF CLASS III DIRECTOR

| | | | |  | | STEPHEN M. ZIDE Age: 59 Age:57

Chairman Director Since:June 2010 Committee Membership: • Compensation

• Nominating & Corporate Governance

| | |

Professional Experience: Mr. Zide is a senior advisor toretired from Bain Capital, in theLP, a private equity business,investment firm, in 2017, having joined the firm in 1997. From 2001 through 2015, Mr. Zide wasserved as a senior advisor of Bain Capital from 2016 through 2017 and as a Managing Director of Bain Capital.from 2001 through 2015. Prior to joining Bain Capital, Mr. Zide was a partner of the law firm of Kirkland & Ellis LLP, where he was a founding member of the New York office and specialized in representing private equity and venture capital firms. Education: Mr. Zide received an MBA from Harvard Business School, a Juris Doctorate from Boston University School of Law, and a B.A. degree from the University of Rochester. Other Public Company Directorships: Current Directorships- Sensata Technologies B.V. (NYSE: ST) since 2010 Past Directorships- HD Supply Holdings, Inc. (NASDAQ: HDS) from 2007 to 2014 Innophos Holdings, Inc. (NASDAQ: IPHS) from 2004 to 2013

Director Qualifications: Mr. Zide brings to the Company’s Board extensive negotiating and financing expertise gained from his training and experience as a legal advisor, and later as a private equity professional and financial advisor. In addition, Mr. Zide has had significant involvement with the Company since its 2010 formation, and has served as a director of numerous public and private companies during his career in private equity and law. | | | | | | | 10 | | |  | | | 2017 Proxy Statement |

2019 Proxy Statement  13 13 Directors with Terms Expiring in 2020 (Class III Directors) | | | | |  |

| K’LYNNE JOHNSON Age: 50 Age:49

Director Since:March 2017 Committee Membership: • Compensation

• Nominating & Corporate Governance

| | |

Professional Experience: Ms. Johnson served as President and Chief Executive Officer of Elevance Renewable Sciences Inc., a specialty chemicals company, from 2007 to 2015, and as Chairwoman from 2015 to 2016. Ms. Johnson joined Elevance after over 20 years’ experience working within the oil and petrochemicals industry for Amoco Corporation and BP p.l.c. (joining BP after its merger with Amoco in 1998). During this time she held both operational and functional roles, culminating in her role as Senior Vice President of Global Derivatives within BP’s global Innovene business, which included P&L accountability for multiple global commodity and specialty chemicals businesses. Education: Ms. Johnson graduated from Brigham Young University with a degree in Management and Organizational Behavior (M.O.B.) and a B.S. in Psychology. Other Public Company Directorships: FMC Current Directorships-

Corporation (NYSE: FMC) since 2013 Director Qualifications: Ms. Johnson brings to our boardthe Company’s Board valuable experience in operational leadership and chemical industry and technological expertise. 14  2019ProxyStatement 2019ProxyStatement | | | | |  |

| DONALD T. MISHEFF Age: 62 Age:61

Director Since:February 2015 Committee Membership: • Audit

• Nominating & Corporate Governance

| | |

Professional Experience: Mr. Misheff served as managing partner from 2003 until his retirement in 2011 of the Northeast Ohio offices of Ernst & Young LLP, a public accounting firm. As the managing partner of the Northeast Ohio offices of Ernst & Young LLP, Mr. Misheff advised many of the region’s largest companies on financial and corporate governance issues. He began his career with Ernst & Young LLP in 1978 as part of the audit staff and later joined the tax practice, specializing in accounting/financial reporting for income taxes, purchase accounting, and mergers and acquisitions. He has more than 30 years of experience performing, reviewing, and overseeing the audits of financial statements of a wide range of public companies. Education: Mr. Misheff graduated from the University of Akron with a B.S. degree in Accounting. Other Public Company Directorships: Current Directorships- TimkenSteel Corporation (NYSE: TMST) since 2014 First Energy Corp. (NYSE: FE) since 2012 Director Qualifications: Mr. Misheff brings extensive financial, accounting and public company corporate governance experience to ourthe Company’s Board. 2019 Proxy Statement  15 15 | |

| HENRI STEINMETZ Age: 62 Director Since: November 2017 Committee Membership: Nominating & Corporate Governance Environmental, Health, Safety & Public Policy |

Professional Experience: Since 2016, Mr. Steinmetz has served as Chief Executive Officer of the Ceramtec Group, a global supplier of advanced ceramics. From 2009 to 2016, Mr. Steinmetz was Executive Director and Chief Executive Officer of Ruetgers N.V., Europe’s leading manufacturer of chemical raw materials made from coal tar. Prior to joining Ruetgers N.V., Mr. Steinmetz was President of Sulzer Metco, a worldwide technology leader in coating materials, from 2004 to 2008, and an Executive Vice President at Great Lakes Chemical Corporation from 2000 to 2004. Education: Mr. Steinmetz graduated with a M.S. in metallurgy from the Technical University Clausthal, Germany and has an MBA from INSEAD Fontainebleau, France. Other Public Company Directorships: None Director Qualifications: Mr. Steinmetz brings significant global chief executive officer experience and decades of chemical industry experience to the Company’s Board. 16  2019ProxyStatement 2019ProxyStatement Directors with Terms Expiring in 2021 | |

| JOSEPH ALVARADO Age: 66 Director Since: March 2017 Committee Membership: Audit Environmental, Health, Safety & Public Policy |

Professional Experience: Mr. Alvarado served as Chief Executive Officer of Commercial Metals Company (NYSE: CMC), a global manufacturer, recycler and marketer of steel and other metals, from September 2011 until September 2017, and as Chairman of CMC’s board of directors from January 2013 until January 2018. He joined CMC in April 2010 as Executive Vice President and Chief Operating Officer, was named President and Chief Operating Officer in April 2011, and became President and Chief Executive Officer in September 2011. In January 2017, he passed his President title to his Chief Operating Officer. Prior to joining CMC, he was President and Chief Operating Officer of Lone Star Technologies, Inc. from 2004 to 2007. In June 2007, following the acquisition of Lone Star Technologies, Inc. by United States Steel Corporation, Mr. Alvarado was named President of U.S. Steel Tubular Products, Inc., a division of United States Steel Corporation, a position he held until March 2009. Mr. Alvarado began his career at Inland Steel Company in 1976 and spent 21 years with the company in roles of increasing responsibility. He then served in executive roles with Birmingham Steel Corporation and Ispat North America Inc. until joining Lone Star Technologies. Education: Mr. Alvarado has an MBA from Cornell University and a B.A. degree in Economics from University of Notre Dame. Other Public Company Directorships: Current Directorships- Kennametal Inc. (NYSE: KMT) since 2018 PNC Financial Services Group Inc. (PNC) since 2019 Past Directorships- Commercial Metals Company (NYSE: CMC) from 2013 to 2018 Spectra Energy Corp (NYSE: SE) from 2011 to 2017 Director Qualifications: Mr. Alvarado brings years of experience in a cyclical commodities-driven industry and significant perspective on global manufacturing operations and strategic planning to the Company’s Board. 2019 Proxy Statement  17 17 | |

| JEFFREY J. COTE Age: 52 Director Since: May 2014 Committee Membership: Audit Compensation |

Professional Experience: Mr. Cote has been President and Chief Operating Officer of Sensata Technologies Holding plc (NYSE: ST) since January 2019. Prior to his appointment, Mr. Cote had served as Chief Operating Officer of Sensata Technologies Holding plc (NYSE: ST) since July 2012 and as Executive Vice President of its Global Sensing Solutions business since November 2015. He joined Sensata as Senior Vice President and Chief Financial Officer in January 2007, and was appointed Executive Vice President in July 2007. From March 2005 to December 2006, Mr. Cote was Chief Operating Officer of the law firm Ropes & Gray. From January 2000 to March 2005, Mr. Cote was Chief Operating, Financial and Administrative Officer of Digitas. Previously he worked for Ernst & Young LLP from 1989 until 1997. Mr. Cote is a certified public accountant. Education: Mr. Cote received a B.A. degree in Business Administration and a Master of Accounting from Florida Atlantic University. Other Public Company Directorships: None Director Qualifications: Mr. Cote brings significant management, financial and accounting experience to the Company’s Board. 18  2019ProxyStatement 2019ProxyStatement | |

| PIERRE-MARIE DE LEENER Age: 60 Director Since: May 2014 Committee Membership: Audit Environmental, Health, Safety & Public Policy |

Professional Experience: Mr. De Leener served as interim Chief Executive Officer of Braas Monier Building Group SA from January 2016 to November 2016 and as Chairman of its board of directors from June 2014 to March 2017. Prior to that, he served as Executive Vice President for PPG Industries, Inc. from July 2010 until December 2012. From June 2008 until August 2011, Mr. De Leener also served as President of PPG Europe S.A. and as Chief Executive Officer of SigmaKalon Group from 1998 until January 2008. Education: Mr. De Leener received a B.S. degree in Economics and Philosophy and a Master of Chemical Engineering degree from Catholic University of Louvain, Belgium. Other Public Company Directorships: None Director Qualifications: Mr. De Leener brings valuable executive management and chemical industry experience to the Company’s Board. | | | | | | | 2017 Proxy Statement | | |  | | | 11 |

CORPORATE GOVERNANCE

2019 Proxy Statement  19 19 Corporate Governance Board Nominees. Under its charter, our nominating and corporate governance committee is responsible for recommending to the Board candidates to stand election to the Board at the Company’s annual general meeting of shareholders and for recommending candidates to fill vacancies on the Board that may occur between annual general meetings. It is the policy of the Board that directors should possess the highest personal and professional ethics, integrity and values. Board members are expected to become and remain informed about the Company, its business and its industry and rigorously prepare for, attend and participate in all Board and applicable committee meetings. The committee evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best perpetuate the success of our business and represent shareholdershareholders’ interests through the exercise of sound judgment using its diversity of experience. In addition, the Board considers, in light of our business and Board composition, each director nominee’s experience, qualifications, attributes and skills that are identified in the biographical information contained under “Proposal 1—Election of Class III Director.”1”. The nominating and corporate governance committee considers properly submitted recommendations for candidates to the Board from shareholders. Any shareholder may submit in writing nominations of persons for consideration for each shareholder meeting at which directors are to be elected by not later than the 90th calendar day nor earlier than the 120th calendar day before the date of the annual general meeting. Any shareholder recommendations for consideration by the Board should include the candidate’s name, biographical information, information regarding any relationships between the candidate and the shareholder within the last three years, a statement of recommendation of the candidate from the shareholder, a description of our shares beneficially owned by the shareholder, a description of all arrangements between the candidate and the recommending shareholder and any other person pursuant to which the candidate is being recommended, a written indication of the candidate’s willingness to serve on the Board of Directors, any other information required to be provided under securities laws and regulations, and a written indication to provide such other information as the Board may reasonably request. Recommendations should be sent to Angelo N. Chaclas, Corporate Secretary, Trinseo S.A., 1000 Chesterbrook Boulevard, Suite 300, Berwyn, PA 19312. The Board evaluates candidates for the position of director recommended by shareholders or others in the same manner as candidates from other sources. The Board will determine whether to interview any candidates and may seek additional information about candidates from third-party sources. The Company has engaged an executive search firm to identify potential Board nominees on behalf of the Board. The executive search firm is instructed to identify candidates meeting the Board’s desires with respect to diversity, experience, skill, and qualifications and perform preliminary screenings of such candidates on behalf of the Board. The Board specifically requested the executive search firm identify at least one candidate who was a Luxembourg resident. Mr. Steinmetz is a Luxembourg resident. Board Independence. Our Corporate Governance Guidelines provide that our Board shall consist of such number of directors who are independent as is required and determined in accordance with applicable laws and regulations and requirements of the NYSE.New York Stock Exchange ("NYSE"). The Board evaluates any relationships of each director and nominee with Trinseo and makes an affirmative determination whether or not such director or nominee is independent. Under our Corporate Governance Guidelines, an “independent” director is one who meets the qualification requirements for being an independent director under applicable laws and the corporate governance listing standards of the NYSE. Our Board reviews any transactions and relationships between each director or any member of his or her immediate family and Trinseo. The purpose of this review is to determine whether there were any such relationships or transactions and, if so, whether they were inconsistent with a determination that the director was independent. As a result of this review, our Board has affirmatively determined that all of our current directors and nominees, except for Mr.Messrs. Bozich and Pappas, are independent under the governance and listing standards of the NYSE.

20  2019ProxyStatement 2019ProxyStatement Diversity and Board Expertise. While we do not have a formal policy with respect to diversity, we believe that the diversity considerations are an important element, among many, when identifying director nominees who will best serve the needs of the Company and the interests of our shareholders. We believe diversity considerations enable us to provide sound and prudent guidance by developing a Board with a diverse range of talents, ages, skills, character, expertise, professional experiences, and backgrounds. Risk Oversight. Risk is inherent in every material business activity that we undertake. Our business exposes us to strategic, credit, market, compliance, operational and reputational risks. To support our corporate goals and objectives, risk appetite, and business and risk strategies, we maintain a governance structure that delineates the responsibilities for risk management activities, and the governance and oversight of those activities, between management and our Board. The Board is committed to | | | | | | | 12 | | |  | | | 2017 Proxy Statement |

CORPORATE GOVERNANCE

strong, independent oversight of management and risk through a governance structure that includes other Board committees. Under our structure, it is management’s responsibility to manage risk and bring to the Board’s attention risks that are material to Trinseo. The Board has oversight responsibility for the systems established to report and monitor the most significant risks applicable to Trinseo. The Board administers its risk oversight role directly and through its committee structure and the committees’ regular reports to the Board at Board meetings. The Board divides its risk oversight responsibilities between itself and its committees by having each review or assess key issues or areas of responsibility as follows: | | | Board of Directors | | • Strategic, financial, and execution risks and exposures associated with our annual and multi-year business plans

Acquisitions and divestures • Capital expenditure and budget planning

Major litigation, investigations, and other matters that present material risk to our operations, plans, prospects, or reputation • Acquisitions and divestures

• Senior management succession planning

| Audit Committee | | • Risks associated with financial accounting matters, including financial reporting, accounting, disclosure, and internal controls over financial reporting

Supervision and selection of our external and internal auditors • Our ethics and compliance programs

• Related party transactions

| Compensation Committee | | • Risks related to the design of our executive compensation programs, plans, and arrangements

Senior management succession planning | Nominating and Corporate Governance Committee | | • Risks related to our governance structures and processes

Director succession planning | Environmental, Health, Safety and Public Policy Committee | | • Our environmental, health and safety risk management programs

• The alignment of our environmental, health, safety, sustainability, social and public policy program with the Company’s business strategy and creation of stakeholder value

|

Board Leadership Structure. Under our Corporate Governance Guidelines, our Board may select a Chairman of the Board of Directors at any time, who may also be an executive officer of the Company. The Board has currently chosen to separate the roles of Chairman and Chief Executive Officer. Mr. Zide, our currentnon-executive Chairman of the Board of Directors, has served as a director since 2010 and brings to the Board extensive knowledge and expertise in strategy, mergers and acquisitions. The Board believes that the separate roles of Mr. Zide and Mr. Pappas,Bozich, our Chief Executive Officer, are in the best interest of Trinseo and its 2019 Proxy Statement  21 21 shareholders, at this time. Mr. Zide hasin-depth knowledge of our business arising from his many years of service to Trinseo and, as a result, provides effective leadership for the Board and support for Mr. PappasBozich and other management. The structure permits Mr. PappasBozich to devote his attention to leading Trinseo and to executing on our business strategy. Board Attendance. We expect our boardBoard members to prepare for, attend and participate in all boardBoard and applicable committee meetings. Our Board held 7seven meetings in 2016.2018. The audit, compensation, and nominating and corporate governance committees held 9, 5,eight, eight, and 4five meetings in 2016,2018, respectively. No Board member attended less than 75% of our boardBoard and committee meetings, as applicable, in 2016.2018. We do not have a policy for the attendance of our directors at our annual general meeting of shareholders. We had twofour directors in attendance for our 20162018 annual general meeting of shareholders for which no shareholders attended. Under Luxembourg law we are required to receive notice by the meeting’s record date of a shareholder’s intention to attend the annual general meeting of shareholders in person. Additionally, our annual general meeting of shareholders, unless there is an exceptional circumstance, are held in Luxembourg. Executive Sessions. Our Corporate Governance Guidelines provide that thenon-management directors of the Board meet in executive session at least once during each regularly scheduled Board meeting to review matters concerning the relationship of the Board with the management directors and other members of senior management and such other matters as it deems appropriate. Additionally, the Board is required to have least one executive session annually of its independent directors. Mr. Zide acts as the chair of these executive sessions. Board Annual Performance Reviews. Pursuant to our Corporate Governance Guidelines the Board annually conducts a self-evaluation of the Board as a whole. In accordance with the written charters of our audit committee, compensation committee | | | | | | | 2017 Proxy Statement | | |  | | | 13 |

CORPORATE GOVERNANCE

and nominating and corporate governance committee, we also evaluate each committee’s performance on an annual basis and report to the Board the findings. Code of Business Conduct. We have adopted a written Code of Business Conduct applicable to all directors, officers and employees and a written Code of Ethics for Senior Financial Employees, applicable to our Chief Executive Officer, Chief Financial Officer, Treasurer, Principal Accounting Officer, Controller, and all employees performing similar functions. These policies are designed to maintain the integrity of our business and financial reporting. These codes cover, among other things, professional conduct, conflicts of interest, accurate recordkeeping and reporting, public communications and the protection of confidential information, as well as adherence to laws and regulations applicable to the conduct of our business. Copies of these codes can be found under the “Corporate Governance” tab and then the “Ethics and Compliance” link on the Investor Relations section of our website,www.investor.trinseo.com. Corporate Governance Guidelines. We have adopted Corporate Governance Guidelines that outline the Board’s governance policies and practices. The current version of our Corporate Governance Guidelines can be found under the “Corporate Governance” tab and then the “Ethics and Compliance” link on the Investor Relations section of our website,www.investor.trinseo.com. Communications with Directors. Shareholders and other interested parties may communicate directly with the Board, thenon-management directors or the independent directors as a group, or specified individual directors by writing to such individual or group c/o Corporate Secretary, Trinseo S.A., 1000 Chesterbrook Boulevard, Suite 300, Berwyn, PA 19312. The Corporate Secretary will forward such communications to the relevant group or individual at or prior to the next meeting of the Board. The Board has instructed our Corporate Secretary to review the correspondence prior to forwarding it, and in his discretion, not to forward certain items if he deems them to be of a commercial or frivolous nature or otherwise inappropriate for the Board’s consideration. In these cases, he may forward some of the correspondence elsewhere in the Company for review and possible response. 22  2019ProxyStatement 2019ProxyStatement Luxembourg Corporate Governance. As a Luxembourg company, we are subject to laws that can significantly restrict our Board’s ability to grant certain rights to shareholders under our articles of association. For example, Luxembourg law: | · | | Imposes a supermajority requirement in order to amend our articles of association, which cannot be amended by the Board or our shareholders; |

| · | | Prohibits a plurality carve out from our majority voting requirement in a contested director election; and |

| · | | Requires shareholder action by written consent in lieu of a meeting to be unanimous. |

| | | | | | | 14 | | |  | | | 2017 Proxy Statement |

2019 Proxy Statement  23 23 Board Structure and Committee Composition We have a standing audit committee, compensation committee and a nominating and corporate governance committee with the composition and responsibilities described below. Each committee operates under a charter that has been approved by our Board of Directors.Board. A copy of each charter can be found by clicking on “Corporate Governance” and then “Committee Composition” in the Investor Relations section of our website,www.investor.trinseo.com. The members of each committee are appointed by the Board of Directors and each member serves until his or her successor is elected and qualified, unless he or she is earlier removed or resigns. In addition, from time to time, special committees may be established under the direction of the Board of Directors when necessary to address specific issues. The table below provides information about the membership of our standing audit, compensation, and nominating and corporate governance committees during fiscal 2016:2018: | | | | | | Nominating | | | | | | | and Corporate | Name | | Audit | | Compensation | | Governance | Joseph Alvarado | | X | | | | | Jeffrey J. Cote | | X* | | X | | | Pierre-Marie De Leener | | X | | | | | K’Lynne Johnson | | | | X* | | X | Philip R. Martens | | | | X | | X | Donald T. Misheff | | X | | | | X* | Henri Steinmetz | | | | | | X | Christopher D. Pappas | | | | | | | Stephen M. Zide | | | | X | | X |

| | | | | | | | | | | | | Name | | Audit | | | Compensation | | | Nominating

and Corporate

Governance | | Jeffrey J. Cote | | | X | * | | | X | (1) | | | | | Pierre-Marie De Leener | | | X | | | | | | | | | | Philip R. Martens | | | | | | | X | (2) | | | X | (2) | Donald T. Misheff | | | X | | | | | | | | X | (1) | Christopher D. Pappas | | | | | | | | | | | X | * | Michel G. Plantevin | | | | | | | X | | | | | | Stephen M. Zide | | | | | | | X | * | | | X | |

(1) | Mr. Cote and Mr. Misheff were appointed as members of our compensation and nominating and corporate governance committees, respectively, effective March 30, 2016. |

(2) | Mr. Martens was appointed as a member of our compensation and nominating and corporate governance committees on September 27, 2016. |

*Denotes the Committee’s Chair for fiscal 2018. Ms. Johnson replaced Mr. Zide as compensation committee chair effective February 2019. Audit Committee The purpose of the audit committee is set forth in the audit committee charter. The audit committee’s primary duties and responsibilities are to: | · | | Appoint or replace, compensate and oversee the outside auditors for the purpose of preparing or issuing an audit report or related work or performing other audit, review or attest services for us and will report directly to the audit committee. |

| · | | Pre-approve all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for us by our outside auditors, which are approved by the audit committee prior to the completion of the audit. |

| · | | Review and discuss with management and the outside auditors the annual audited and quarterly unaudited financial statements, our disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and the selection, application and disclosure of critical accounting policies and practices used in such financial statements. |

| · | | Review and approve all related party transactions as defined under Item 404(a) of Regulation S-K. |

| · | | Discuss with management and the outside auditors significant financial reporting issues and judgments made in connection with the preparation of our financial statements, including any significant changes in our selection or application of accounting principles, any major issues as to the adequacy of our internal controls and any special steps adopted in light of material control deficiencies. |

Appoint or replace, compensate and oversee the outside auditors for the purpose24  2019ProxyStatement 2019ProxyStatement Pre-approve all auditing services and permittednon-audit services (including the fees and terms thereof) to be performed for us by our outside auditors, which are approved by the audit committee prior to the completion of the audit.

Review and discuss with management and the outside auditors the annual audited and quarterly unaudited financial statements, our disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and the selection, application and disclosure of critical accounting policies and practices used in such financial statements.

Review and approve all related party transactions as defined under Item 404(a) ofRegulation S-K.

Discuss with management and the outside auditors significant financial reporting issues and judgments made in connection with the preparation of our financial statements, including any significant changes in our selection or application of accounting principles, any major issues as to the adequacy of our internal controls and any special steps adopted in light of material control deficiencies.

A copy of the charter, which satisfies the applicable standards of the Securities and Exchange Commission (the “SEC”) and the NYSE is available on our website.website, www.trinseo.com. The audit committee currently consists of Donald T. Misheff, Joseph Alvarado, Jeffrey J. Cote, and Pierre-Marie De Leener.Leener, and Donald T. Misheff. Our Board has determined that each of Messrs. Misheff,Alvarado, Cote, and De Leener and Misheff are independent directors pursuant to Rule 10A-3(b)10A‑3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 303A.02 of the New York Stock Exchange Listed Company Manual. Each of Messrs. MisheffCote and CoteMisheff is also an “audit committee financial expert” within the meaning of Item 407(d)(5) ofRegulation S-K. Mr. Cote also serves as chair of the audit committee. | | | | | | | 2017 Proxy Statement | | |  | | | 15 |

BOARD STRUCTURE AND COMMITTEE COMPOSITION

Compensation Committee Compensation Committee

The purpose of the compensation committee is to assist the Board in fulfilling its responsibilities relating to oversight of the compensation of our directors, executive officers and other employees and the administration of our benefits and equity-based compensation programs. The compensation committee reviews and recommends to our Board compensation plans, policies and programs and approves specific compensation levels for all executive officers. The compensation committee currently consists of Jeffrey J. Cote, K’Lynne Johnson, Philip R. Martens, and Stephen M. Zide. Messrs. Cote and Martens and Ms. Johnson joined the compensation committee in March 2016, September 2016, and April 2017, respectively. Mr. Zide serves as chair of the compensation committee. A copy of its charter, which satisfies the applicable standards of the SEC and the NYSE, is available on our website.website, www.trinseo.com. Pursuant to its charter, the compensation committee may delegate to subcommittees of the compensation committee any of the responsibilities of the full committee. Nominating and Corporate Governance Committee The purpose of the nominating and corporate governance committee is to (i) identify, screen and review individuals qualified to serve as directors (consistent with criteria approved by our Board) and recommend to our Board candidates for nomination for election at the annual meeting of shareholders or to fill Board vacancies or newly created directorships; (ii) develop and recommend to our Board and oversee the implementation of our corporate governance guidelines; (iii) oversee evaluations of our Board and (iv) recommend to our Board candidates for appointment to board committees. The nominating and corporate governance committee currently consists of K’Lynne Johnson, Philip R. Martens, Donald T. Misheff, Henri Steinmetz, and Stephen M. Zide. Messrs. Misheff and Martens joined the nominating and corporate governance committee in March 2016 and September 2016, respectively. Ms. Johnson joined the nominating and corporate governance committee in April 2017. Mr. Misheff serves as chair of the nominating and corporate governance committee. Our Board has adopted a written charter under which the nominating and corporate governance committee operates. A copy of the charter is available on our website.website, www.trinseo.com. Compensation Committee Interlocks and Insider Participation None of our executive officers serves as a member of the board of directors or the compensation committee of any other company that has any executive officers serving as a member of our Board or compensation committee. | | | | | | | 16 | | |  | | | 2017 Proxy Statement |